Viral Mars Footage Sparks Frenzy as Rover Records Mysterious Moving Object on Surface. 8386

In a discovery that has ignited both excitement and disbelief across the globe, NASA scientists have confirmed that a Mars rover captured footage of what appears to…

Mysterious Saucer and “Mars Figure” Spotted in NASA Rover Image — Coincidence or Proof?. 8386

An image captured by NASA’s Curiosity rover in 2015 has once again ignited fierce debate across the internet and scientific communities. At first glance, it seems like…

The Most Controversial Teen Movies Of All Time

Whether it’s a wholesome Disney Channel Original movie or a heavier story being told on the big screen, teen movies can have a profound effect on those…

My Ex Wanted to Reconnect with Our Daughter, I Had to Understand His True Intentions

When my ex-husband, Leo, called to say he wanted to reconnect with our daughter, Lily, I felt something I hadn’t in a long time — hope. It…

Inside a ‘Dystopian’ Apartment Block Where That Houses Over 20,000 Residence

It’s been labeled ‘the most sustainable living building on Earth’ In Hangzhou, China, the Regent International apartment complex, capable of housing up to 30,000 residents, has gained…

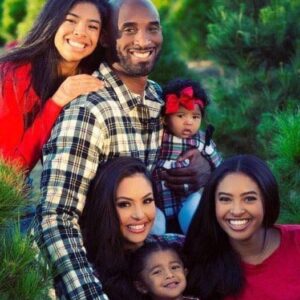

Another loss for the Bryant family… We are heartbroken

Another Terrible Loss For The Bryant Family, Sending Prayers Joe “Jellybean” Bryant, father of NBA legend Kobe Bryant and former NBA player, has died at 69. La…

The search for little Tallyson comes to an end; he was found without a c…

Relief swept through the community when authorities confirmed that little Tallyson had been found safe and healthy. After days of restless nights, shared flyers, and whispered prayers,…

“My real mom is in the well.” Four-year-old Ethan Ward said this one afternoon as he rolled his stroller across the carpet.

But what he said next would unravel everything they thought they knew about their lives — and each other. His mother, Lydia Ward, froze mid-step. His father,…

Megalodon Strikes in the Bermuda Triangle. In a shocking turn of events, the legendary Megalodon has reportedly surfaced in the Bermuda Triangle, allegedly destroying an army warship-TRAMLY

A Shocking Encounter in the World’s Most Mysterious Waters The Bermuda Triangle has long been the subject of myth, speculation, and fear. From vanishing ships to…

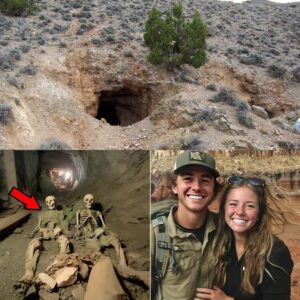

Sarah Bennett, 26, and Andrew Miller, 28, were an ordinary couple from Colorado, just looking for a weekend getaway. They weren’t thrill-seekers… BN

Two tourists vanished in the Utah desert in 2011 — in 2019 they were found in an abandoned mine… Utah Desert, USA — It was supposed to…