Aftеr bеing rеjеctеd by his Mօthеr, Smаll Dееr finds his bеst cаrеr, this swееt Cаt!

This is a wonderful and inspiring friendship story…! So adorable Kitty Cat and deer best of friends, PRECIOUS  That is so adorable! The cat is truly…

Love how different species can get along with each other. Amazing animals❤️

This is so precious and such a beautiful love between different species. Wouldn’t it be wonderful if humans could be like this. Lovable GOD given animals ♥️ they deserve…

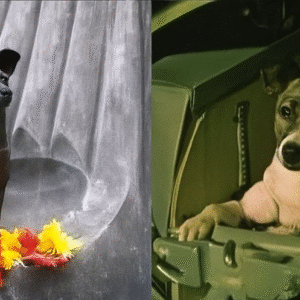

🌌 67 Years ago, Laika was sent into Space!

We are protectors, guardians, entrusted with their care while they walk this earth. Today, I feel a duty to commemorate her. Not out of…

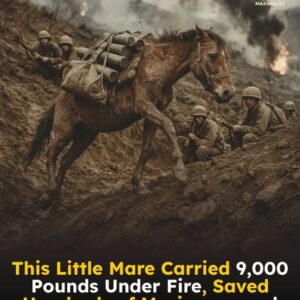

Wait… this was a horse? That’s incredible!

She wasn’t a horse – she was a marine. Her statue at the Kentucky Horse Park. She should never have had to endure all of that….

A rare rescue: Orphaned Walrus Calf finds Comfort & Care at Alaska SeaLife Center!

This is absolutely heartwarming! On Alaska’s remote North Slope — where icy winds sweep across the edge of the world — oil field workers made an astonishing…

The Great Mud Rescue”

It was supposed to be a peaceful morning drive through the countryside. Mei hopped on her scooter with her little dog, Bobo, to visit the rice fields….

(VIDEO) Heart-Stopping Moment: Elephant Gives Birth To Rare Twins – Then Something Truly Amazing Happened!

If only humans would behave with such love and sense of community. Animals are far more caring than many humans! That is the sad part…

Kitten Found Sleeping Beside Mother Who Had Pa.ss.ed Aw.ay!

A [he.artbre.aking] scene has moved people around the world: a tiny kitten sleeping in its mother’s arms, unaware that she had already [pa.ss.ed aw.ay]. On the 29th…

HE KICKED HIS PREGNANT WIFE INTO THE SHARK POND , UNAWARE OF HIS $1B FORTUNE – bn

The Pond Was Just Beginning “You worthless, ungrateful woman. After everything I’ve done for you…” Adabo’s voice thundered through the penthouse, rattling the windows and sending our…

A Heartwarming Story: Man Wheelbarrows His D.y.ing Dog Up His Favorite Mountain One Last Time!

Only fur baby moms & dads know the feeling. It’s heartwarming! Sometimes human-animal friendships are very deep but also very short; the [s.a.ddest] thing is seeing your…